Phil Falcone, a prominent yet controversial figure in the hedge fund world, has recently sold his prized Hamptons mansion for $14 million in an all-cash deal. The transaction marks the end of Falcone’s ownership of the luxurious estate, a culmination of several years of publicized financial and legal battles that plagued the former billionaire. Once at the height of the financial world with a net worth exceeding $1 billion, Falcone’s fall from grace was marked by significant lawsuits, business struggles, and a tarnished reputation in the financial sector.

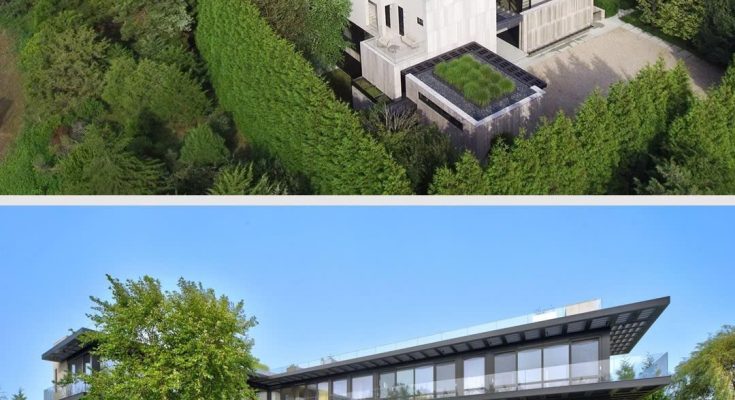

The Sagaponack mansion, situated in one of the Hamptons’ most coveted areas, has been a symbol of Falcone’s once-grand lifestyle. Originally purchased in 2006 for $5.5 million, the property underwent extensive renovations and expansions under Falcone’s ownership, turning it into a magnificent 14,000-square-foot estate with luxurious amenities such as a private movie theater, a gym, an outdoor pool, and stunning views of the surrounding landscapes. The sprawling estate features seven bedrooms, 15 bathrooms, and sits on a vast piece of land just a short distance from the ocean.

Despite the property’s grandeur and prime location, Falcone’s financial troubles likely played a significant role in his decision to sell. Over the years, Falcone faced various legal disputes, including a high-profile lawsuit with the SEC, which resulted in a ban from the securities industry. His net worth plummeted from its peak, and Falcone was forced to sell off several of his assets, including this Hamptons mansion, to settle his debts and liabilities.

The sale of the estate marks the end of an era for Falcone, whose downfall has been closely watched by financial analysts and the media alike. His Hamptons home, once a testament to his success and lavish lifestyle, now passes into new hands, bringing closure to one of the many chapters in Falcone’s tumultuous journey. The buyer, who remains anonymous, secured the property for $14 million in cash, far below the $24.5 million it was listed for earlier in 2022.

The mansion, designed by architect Brian O’Keefe, is a masterpiece of modern architecture, blending sleek design with the natural beauty of the Hamptons landscape. Features of the property include a 9,000-square-foot living area, a state-of-the-art kitchen with Poliform design, and an expansive roof deck offering 360-degree views of the ocean and the surrounding area. The estate’s lower level features additional entertainment amenities such as a home theater, gym, spa, and wine cellar, making it the ideal home for entertaining and relaxation.

Though Falcone’s financial struggles may have tarnished his legacy in the business world, his former Hamptons home stands as a lasting symbol of his once-great empire, now passed on to its next steward.